Is your mortgage currently in forbearance?

Mortgage forbearance provided a lifeline for millions of homeowners during the difficult months of the pandemic.

But with the six-month end date for many forbearance plans rapidly approaching, homeowners will have to decide how to move forward.

Do you need to extend your COVID forbearance plan for another six months?

Or, are you ready to exit? If so, what are your options?

Here’s what you need to know if your mortgage forbearance plan is ending soon.

Millions of COVID forbearance plans are about to end

The CARES Act offered much-needed mortgage relief for U.S. homeowners.

Under the Act, if you have any mortgage backed by the federal government— including conventional, FHA, VA, and USDA loans — you can pause your mortgage payments for up to six months with no penalties.

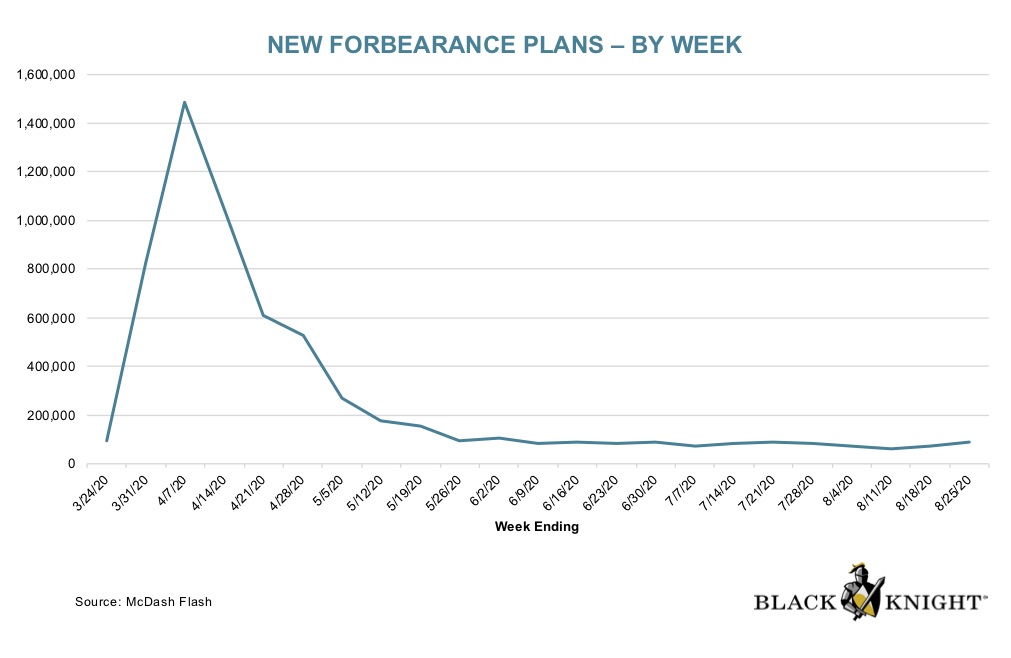

As shown in the chart below, millions of homeowners opted in for CARES Act mortgage forbearance in March and April, when the economy took its first hard hit.

Chart showing the number of new forbearance plans over time. New forbearance plans spiked in March and April, then leveled off in May through August. Source: Black Knight

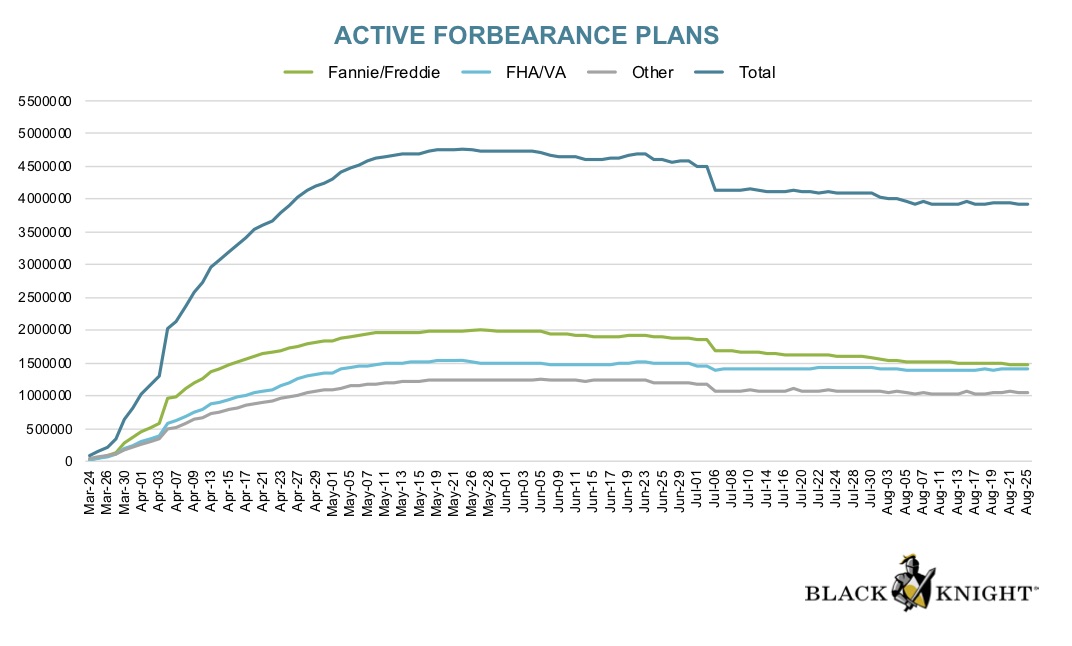

To date, the majority of homeowners who opted for mortgage relief are still in their forbearance plans.

But with the initial six month deadline nearing, many will be approaching their forbearance deadlines in September and October.

Chart showing the number of active forbearance plans for U.S. mortgages, which has hardly dropped since the initial spike in March and April. Source: Black Knight

So, what are you supposed to do if your forbearance plan is ending?

You’re free to exit forbearance if you’re able to resume making mortgage payments. If not, you might be able to extend your forbearance plan.

We’ll walk you through your optinos below.

Most forbearance plans can be extended for 6 more months

Six months of forbearance may have provided you a welcome buffer period to get back on solid financial ground.

But if you continue to experience money problems due to lack of employment, medical bills, or otherwise, you’re probably worried about how you’re going to pay the mortgage.

The good news? You can get a six-month extension on your loan forbearance.

That means a total mortgage forbearance period of 12 months on your government-backed loan if you need it.

Conventional, FHA, VA, and USDA loan holders can opt for another 6 months of mortgage forbearance if necessary, for a total of 12 months of mortgage relief

“From the date you seek to have forbearance, you will be entitled to that forbearance for up to one year, with an extension after the first six months of your forbearance,” explains David Shapiro, president and CEO of EquiFi Corporation.

“Forbearance plans are based on when you requested them. So if a homeowner requested forbearance in March or April at the beginning of the pandemic, September or October would be the end for the first 180 days.”

How do you request an extension?

Dongshin Kim, assistant professor of finance and real estate at Pepperdine Graziadio Business School, says your loan servicer should provide you an option to extend forbearance another 180 days if you need it.

“Loan servicers are supposed to reach out to borrowers 30 days before the forbearance plan is scheduled to end to help them understand what options they have for repayment,” says Kim.

Your loan servicer should reach out 30 days before your forbearance plan ends to discuss your options

But you shouldn’t necessarily wait for your lender or servicer to contact you about this option.

“If you need to continue your forbearance, contact your mortgage servicer well ahead of your forbearance end date,” recommends Jackie Boies, senior director of housing services at Money Management International.

“You need to prepare for relief to end now. Do not wait until you get your statement to ask a lender for help. Instead, contact them now, let them know your financial situation, and see how they can help.”

Strategies for exiting mortgage forbearance

If you are ready to exit your forbearance on time, after six months, be prepared for what happens next.

“Forbearance is not loan forgiveness. Borrowers will still owe the principal and interest that they didn’t pay during the forbearance period,” notes Kim.

“Borrowers will need to make both the regular mortgage payments and also all the payments they missed while the loan was in forbearance.”

You will typically have several options for repayment once forbearance expires:

- Full repayment, which is a one-time lump sum payment. It’s possible to pay back all the missed payments at once. But lenders are NOT allowed to require this. “If you are unable to pay the lump sum, you have other options,” says Boies

- Intermittent payments, where you arrange repayment with your servicer over three, six, nine, or 12 months –—whichever makes the most sense — on top of your regular payments

- Lengthen your loan term and pay off the missed amount at the end of the extended loan term, with additional mortgage payments

- Defer your repayment. This option lets you pay off the missed amount at the time the home is sold, refinanced, or the mortgage term ends

- Pursue a loan modification. “This helps borrowers who are at risk of default change their mortgage terms – usually including a lower interest rate, reduced length of the loan, or reduced monthly payment,” adds Boies

The right option for you depends on your current finances, employment status, and ability to resume mortgage payments.

When your loan servicer contacts you, be sure to discuss every option in detail so you know exactly what to expect with the repayment plan you select.

The experts warn that you should anticipate a few possible snags and setbacks post-forbearance, especially when it’s time to contact your loan servicer.

“Borrowers should expect very long delays and may experience inconsistency in customer support representatives,” cautions Shapiro.

“Loan servicing organizations are not all properly staffed for the expected volume of forbearances, and they can’t train support agents fast enough to meet their needs.

“Also,” Shapiro continues, “be prepared for process changes, as regulators react to the crisis in real-time and create new rules or modify existing rules.”

Even if you can’t get through on the first few contact attempts, don’t give up.

“Be patient, but be persistent. Mortgage servicers have struggled to keep up with calls during the COVID crisis, but many have made online options easy and added staffing,” says Boies.

Keep a close eye on your credit report and score

Also, if your mortgage has been in forbearance, check your credit report carefully.

CARES Act rules state that mortgages in forbearance should not be reported as having late or missed payments. And the forbearance plan should not harm your credit score.

But this is another area where mistakes can happen.

“Sometimes there can be mistakes and issues with credit scores that can pop up around forbearance,” Kim says.

Remember, lenders and servicers have never before had to deal with mortgage forbearances on this scale. So it’s up to the borrower to be extra-vigilant and make sure nothing slips through the cracks.

Check your loan statements every month and stay on top of your credit report.

Remember, you get one free credit report per week through April 2021. So you can keep a closer eye on it than usual.

What if you still can’t afford your mortgage payments after forbearance?

The worst-case scenario: Forbearance ends and you still can’t pay your monthly mortgage. What can you do?

“You’ll probably need to consider disposition options,” says Boies.

“This may include selling your home if you can no longer afford it. Foreclosure, short sale, and deed-in-lieu are other ways of disposing of a home you can’t afford.”

Boies warns, “These options may be damaging to your credit and should be reserved until you’ve exhausted all other solutions.”

You can end forbearance early, too

You don’t have to wait for a six- or 12-month forbearance period to come to an end. Instead, you can opt to exit forbearance earlier than expected.

Just be prepared to pay back the amount you weren’t able to pay while forbearance was in place, cautions Kim.

“The best time to end forbearance is when the borrower is comfortable and able to make payments, including the additional money for repayments they owe,” Kim adds.

If you’re ready to end forbearance, contact your loan servicer and request this.

“But be sure your financial foundation is strong enough, meaning you have some type of emergency fund to back up your ability to pay your mortgage,” suggests Shapiro.

Low rates can make mortgage payments more affordable

For those exiting mortgage forbearance in the next few months, there may be an opportunity to lower your mortgage payments below pre-pandemic levels.

Rates have hit record lows nine times in 2020, and are set to remain low for months — if not years — to come.

Some options for exiting mortgage forbearance would allow homeowners to secure a new, lower rate and make their monthly payments more manageable.

Ask your servicer about loan modification and refinancing.

If these options are avaialble to you, you might be able to exit forbearance much more confidently, knowing that you’ll have a more affordable mortgage payment on the other side.

Verify your new rate (Sep 24th, 2020)tinyurlis.gdv.gdv.htu.nuclck.ruulvis.netshrtco.detny.im

مقالات مشابه

- شرکت صادرات و واردات کالاهای مختلف از جمله کاشی و سرامیک و ارائه دهنده خدمات ترانزیت و بارگیری دریایی و ریلی و ترخیص کالا برای کشورهای مختلف از جمله روسیه و کشورهای حوزه cis و سایر نقاط جهان - بازرگانی علی قانعی

- می تواند در سه ماهه سوم این سال بود که "سریعترین رشد در تاریخ ایالات متحده"?

- شرکت صادرات و واردات کالاهای مختلف از جمله کاشی و سرامیک و ارائه دهنده خدمات ترانزیت و بارگیری دریایی و ریلی و ترخیص کالا برای کشورهای مختلف از جمله روسیه و کشورهای حوزه cis و سایر نقاط جهان - بازرگانی علی قانعی

- تاثیر نمک صورتی در بهبود حافظه

- اتاق بازرگانی دست و پنجه نرم کردن با بیماری همه گیر را بار بر روی کسب و کارهای محلی

- جدید COVID-19 قوانین وام مسکن برای وام خود اشتغالی

- قابل توجه وب سایت - لوازم عکاسی به شما امکان میدهد به آنجا برسیم

- لوازم خانگی اسمگ - اسمگ

- مصرف کننده گزارش مدیر عامل در مبارزه برای حمایت از ما در جهان آنلاین

- شرکت صادرات و واردات کالاهای مختلف از جمله کاشی و سرامیک و ارائه دهنده خدمات ترانزیت و بارگیری دریایی و ریلی و ترخیص کالا برای کشورهای مختلف از جمله روسیه و کشورهای حوزه cis و سایر نقاط جهان - بازرگانی علی قانعی